Reposted with permission. Originally published on the GSMA website as Sanitation for climate action: our reflections from World Water Week 2025 by Zachary White, Senior Insights Manager, Digital Utilities, GSMA.

World Water Week is one of the water and sanitation sector’s biggest annual events. This blog summarises the key insights for a session hosted at the conference by the GSMA’s Digital Utilities programme and CBSA, together with two innovative sanitation providers working on integrating carbon revenues into their business model: the Sanergy Collaborative in Kenya and SOIL in Haiti. The session explored the under-appreciated link between sanitation services and climate mitigation, how providers are working on addressing this, and how they can access the carbon markets to support scaling services.

The sanitation-climate link

The link between sanitation and climate change is not one at the front of many people’s minds, yet non-sewered sanitation alone (i.e. excluding conventional wastewater treatment) is responsible for 377 million tonnes of CO2e per year. This is 4.7% of all anthropogenic methane, and equivalent to over 40% of the global aviation industry’s total emissions. With 47% of the world’s population using on-site/non-sewered sanitation, and the majority of those in low- and middle-income countries, extending better sanitation services that can also dramatically lower methane presents as a clear win-win. Further, given sewage treatment has previously been estimated to contribute 7% of global anthropogenic emissions and that real-world methane measurements have been found to be double IPCC estimates it is clear that sanitation represents a major climate policy blind spot.

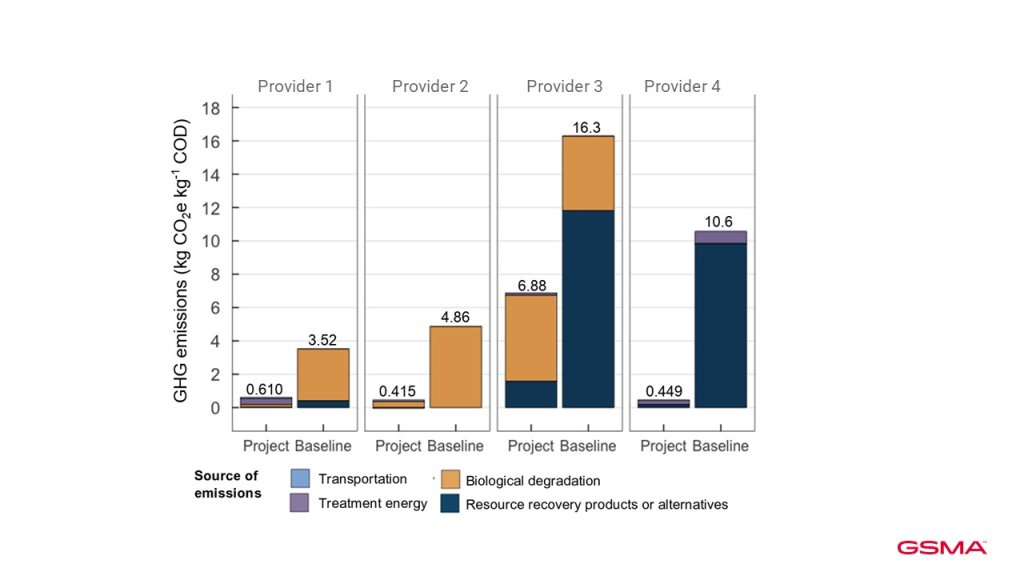

The key to understanding emissions in sanitation is anaerobic digestion: the general principle is that the longer waste is decomposing in a low-oxygen environment, the more methane will be produced. Treatment that is based on frequent collection and aerobic treatment (such as composting) can significantly reduce the emissions produced. Many container-based sanitation providers operate on these principles, as their models are based on using small and sealable household containers that are frequently emptied and taken to treatment facilities. This model is particularly well suited to a range of hard-to-reach contexts where installing sewers, septic tanks, and pit latrines can be challenging. In terms of emissions reductions, a 2022 CBSA study of four providers found dramatic mitigation potential, with 79% to 93% of baseline emissions eliminated.

Emissions reductions from four container-based sanitation providers

Source: CBSA

Accessing the carbon markets

Despite the high mitigation potential, accessing carbon finance remains a challenge for many sanitation providers. Key barriers include: high up-front costs, limitations in precedent and a lack of tailored methodologies, and the scale of operations. Accessing the voluntary carbon markets generally requires cash expenditures of $200-250k per project (generally 5-7 years). Many of these costs are fixed, meaning a certain scale (at least 10,000-20,000 tonnes/credits per project) is required to break even in cash terms. Additionally, a large portion of this expenditure will be up-front, meaning organisations have to either be able to absorb the negative cash flow for the project, or find a financing partner who can. Despite these challenges, two organisations presenting during the session are breaking ground in issuing some of the first carbon credits based on household sanitation services:

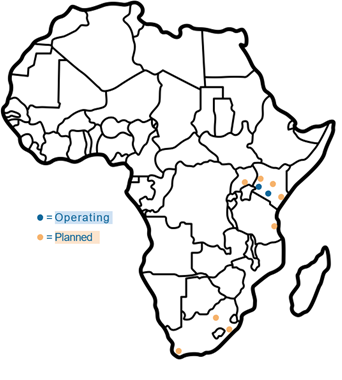

- Sanergy are a container-based sanitation provider in Kenya that treat the faecal waste – alongside agricultural waste – through composting, briquetting, and black soldier fly rearing. They are one of the largest providers of container-based services, serving 300,000 people daily. They began their carbon credit journey in mid-2022 and had their project approved in late 2024 (Verra Project ID 4015). There is no specific methodology for sanitation so they used the UNFCCC ACM0022 methodology for Alternative Waste Treatment Processes. They have successfully sold all of their first issuance of 6,640 credits; achieving a target premium price of ~$20 per credit. Their second issuance of 27,820 credits is expected in Q3 2025 and from 2027 they will be targeting an issuance of 30,000 per year as part of a major planned expansion regionally.

Sanergy’s plans for expansion.

- SOIL operate a similar model to Sanergy in Haiti, albeit at a smaller and more localised scale. SOIL have 3,900 household subscribers and treat the waste through composting. SOIL do not sell credits via conventional routes, rather their story began with working with the University of Hawaii and University of California to directly measure the carbon emissions from their treatment compared to waste stabilisation ponds. Under that research they found that there was a 90% reduction in greenhouse gas emissions: roughly equivalent to 1 tonne per household per year – with the results published in peer-reviewed journals: Greenhouse gas fluxes from human waste management pathways in Haiti and Climate change mitigation potential in sanitation via off-site composting of human waste. This work was intended to accurately quantify the carbon impact rather than sell the credits per se, but the rigorous quantification caught the attention of some specific corporate buyers who were seeking ways to offset their emissions which ensured 100% of their financing went towards implementation by avoiding the high transactional costs of the voluntary market. These buyers trusted in peer-reviewed research and were happy to purchase credits directly and without third-party issuance/verification. To date SOIL has sold more than 3,000 tonnes of offsets at $30 per tonne and are seeking to expand this partnership model in coming years to cover up to 10% of the costs of sanitation service provision.

SOIL’s composting facility in Haiti.

Key insights from the session

- Scale matters – While Sanergy’s story is one to celebrate, few providers are operating at the scale they are, effectively barring them from the formal market. International NGOs in the session shared that they had quantified the carbon reduction benefits of certain projects and would need to aggregate across many projects to reach the scale needed to breakeven in cash terms in the voluntary market. For those organisations, the project timeline and complexity of doing so presents another challenge to accessing the market. There is potential for market aggregators and methodology developers to step in and help de-risk the market.

- The potential for digital is only just emerging – the monitoring and verification costs are one of the largest costs in the voluntary market and the major standards (e.g. Verra and Gold Standard) are only just beginning to explore the use of digital technology in lowering them. In a major first in the clean cooking sector, GSMA Innovation Fund Alumni ATEC issued digitally-verified credits under a new Gold Standard methodology.

- The revenue potential of the voluntary market is small in relation to overall revenues, but provides an important route to other climate finance – the contribution of the voluntary market revenues for both businesses is small (<10%) in relation to total revenues. However, the rigorous quantification of emissions in the sector paves a way for them, and others, to access other climate finance such as the Green Climate Fund. This quantification will also be important as countries and the UN scale the Article 6.2 and 6.4 mechanisms.

- Peer-reviewed research offers opportunities for smaller providers – Although still a unique case, SOIL’s partnership with Global Water Intelligence over the past 5 years provides an example of how smaller organisations may be able to creatively leverage scientific research to create direct partnership models whereby companies or individuals can purchase carbon offsets directly, removing the cost barriers for accessing financing. This type of partnership is limited in scale but could represent a pathway towards increased revenue for small providers, reducing overall costs to the household customer and public sector.

A new GSMA resource for startups

Many of the carbon-saving companies funded under the GSMA Innovation Fund look to the carbon markets as part of their scaling. However, few have access to good guidance on the process and expected costs. To support companies to know how and when to – and also importantly when not to – enter the carbon markets we developed an online guide. It contains: A plain language summary of the key concepts and definitions; a mapping of the key ecosystem players and their roles; details of the expected costs and anticipated revenues – with a breakeven calculator for key sectors; and guidance on your routes to market, and key considerations for sales strategies.

CBSA will soon write up the lessons from sanitation carbon credits projects, details of which will be shared on our website and through our newsletter.